Intrinsic influence mechanisms of dry bulk ship investment and ordering

-

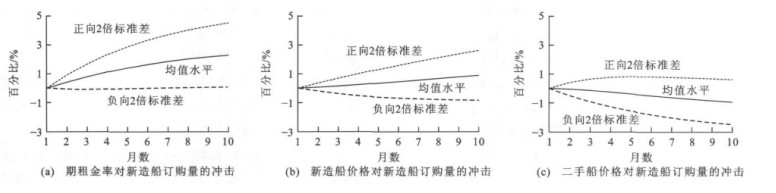

摘要: 应用动态计量经济理论与方法, 研究了干散货运输船舶订购的内在影响机制, 分析了3种主要干散货船型的新船价格、二手船价格和期租金率与新船订购量之间的动态关系。研究结果表明: 不同船型的新船价格之间、二手船价格之间均不存在协整关系, 而各种船型的订购量、新船价格、二手船价格和期租金率之间存在协整关系; 船舶订购量与期租金率负相关, 与新船价格正相关; Capsize型船舶的二手船价格与其订购量正相关, Panamax型船舶的二手船价格与其订购量负相关, Handymax型船舶的二手船价格与其订购量关系不显著; 各种船型的期租金率对于船舶订购量的冲击最大; Handy-max型船舶的新船造价对于订购量的冲击在各类船舶中最小; Panamax型船舶的二手船价格对于订购量的冲击是正向的, 而Capsize型船舶和Handymax型船舶二手船价格对于订购量的冲击是负向。Abstract: The intrinsic influence mechanisms of dry bulk ship ordering were studied by using the theory and approach of dynamic econometrics. The dynamic relationships among new ship prices, second-hand ship prices, time charter rates and ordering volumes of three main kinds of dry bulk ships were analyzed. Analysis result shows that there are no cointegration relationships among new ship prices and second-hand ship prices for three kinds of dry bulk ships, and there are cointegration relationships among new ship price, second-hand ship price, time charter rate and ordering volume for every kind of dry bulk ship. Ship ordering volume has positive relationship with new ship price, and negative relationship with time charter rate. The relationship between second-hand ship price and ship ordering volume for Capsize ship is positive, it is negative for Panamax ship, and it is not significant for Handymax ship. Impulses from time charter rates to ship ordering volume are the biggest for three kinds of ships. Impulse from new ship price to ship ordering volume for Handymax ship is the smallest among three kinds of ships. Impulse from second-hand ship price to ship ordering volume for Panamax ship is positive, while it is negative for Capsize ship or Handymax ship.

-

表 1 时间序列的单位根检验结果

Table 1. Unit root test results of time series

表 2 GARCH模型的估计结果

Table 2. Estimation results of GARCH model

表 3 各种船型新船价格之间的协整关系检验

Table 3. Cointegration test of new ship prices for different ship types

表 4 各种船型二手船价格之间的协整关系检验

Table 4. Cointegration test of second-hand ship prices for different ship types

表 5 订购量、新船价格、二手船价格和期租金率之间的协整关系检验

Table 5. Cointegration test of ordering volumes, new ship prices, second-hand ship prices and time charter rates

表 6 Capsize型船Granger因果检验

Table 6. Granger causality test of Capsize ship

表 7 Panamax型船的Granger因果检验

Table 7. Granger causality test of Panamax ship

表 8 Handymax型船的Granger因果检验

Table 8. Granger causality test of Handymax ship

表 9 Capsize型船订购的VECM模型估计结果

Table 9. Estimation results of VECM models for Capsize ship ordering

表 10 Panamax型船订购的VECM模型估计结果

Table 10. Estimation results of VECM models for Panamax ship ordering

表 11 Handymax型船订购的VECM模型估计结果

Table 11. Estimation results of VECM models for Handymax ship ordering

-

[1] BEENSTOCK M, VERGOTTIS A. An econometric model of the world market for dry cargo freight and shipping[J]. Applied Economics, 1989, 21 (3): 339-356. doi: 10.1080/758522551 [2] HALE C, VANAGS A. The market for second-hand ships: some results on efficiency using cointegration[J]. Maritime Policy and Management, 1992, 19 (1): 31-39. doi: 10.1080/03088839200000003 [3] GLEN D R. The market for second-hand ships: further results on efficiency using cointegration analysis[J]. Maritime Policy and Management, 1997, 24 (3): 245-260. doi: 10.1080/03088839700000029 [4] 张仁颐. 二手船购置价格的确定[J]. 上海交通大学学报, 1996, 30 (10): 69-72. https://www.cnki.com.cn/Article/CJFDTOTAL-SHJT610.011.htmZHANG Ren-yi. Determination of purchasing price for second hand ship[J]. Journal of Shanghai Jiaotong University, 1996, 30 (10): 69-72. (in Chinese) https://www.cnki.com.cn/Article/CJFDTOTAL-SHJT610.011.htm [5] ALIZADEH A H, NOMIKOS N K. The price-volume relationship in the sale and purchase market for dry bulk vessels[J]. Maritime Policy and Management, 2003, 30 (4): 321-337. doi: 10.1080/0308883032000145627 [6] 王志鹏. 船舶投资时机的研究[D]. 大连: 大连海事大学, 2004.WANG Zhi-peng. Research on ship investment opportunity[D]. Dalian: Dalian Maritime University, 2004. (in Chinese) [7] BENDALL H B, STENT A F. Ship investment under uncertainty: valuing a real option on the maximum of several strategies[J]. Maritime Economics and Logistics, 2005, 7 (1): 19-35. doi: 10.1057/palgrave.mel.9100122 [8] ENGELEN S, MEERSMAN H, VAN DE VOORDE E. Using system dynamics in maritime economics: an endogenous decision model for shipowners in the dry bulk sector[J]. Maritime Policy and Management, 2006, 33 (2): 141-158. doi: 10.1080/03088830600612807 [9] SYRIOPOULOS T, ROUMPIS E. Price and volume dynamics in second-hand dry bulk and tanker shipping markets[J]. Maritime Policy and Management, 2006, 33 (5): 497-518. doi: 10.1080/03088830601020729 [10] 李耀鼎. 不确定条件下的船舶投资决策研究[D]. 上海: 上海海事大学, 2007.LI Yao-ding. Ship investment under uncertainty[D]. Shanghai: Shanghai Maritime University, 2007. (in Chinese) [11] MERIKAS A G, MERIKA A A, KOUTROUBOUSIS G. Modelling the investment decision of the entrepreneur in the tanker sector: choosing between a second-hand vessel and a newly built one[J]. Maritime Policy and Management, 2008, 35 (5): 433-447. doi: 10.1080/03088830802352053 [12] LUO Mei-feng, FAN Li-xian, LIU Li-ming. An econometric analysis for container shipping market[J]. Maritime Policy and Management, 2009, 36 (6): 507-523. doi: 10.1080/03088830903346061 [13] CAMPBELL J Y, SHILLER R J. Valuation ratios and the long-run stock market outlook[J]. The Journal of Portfolio Management, 1998, 24 (2): 11-26. doi: 10.3905/jpm.24.2.11 [14] CHEN Y S, WANG S T. The empirical evidence of the leverage effect on volatility in international bulk shipping market[J]. Maritime Policy and Management, 2004, 31 (2): 109-124. doi: 10.1080/0308883042000208301 [15] 翟海杰, 李序颖. 不同分布的GARCH族模型的波罗的海干散货运价指数波动率[J]. 上海海事大学学报, 2009, 30 (3): 59-64, 68. doi: 10.3969/j.issn.1672-9498.2009.03.014ZHAI Hai-jie, LI Xu-ying. Volatility of Baltic dry index using GARCH type models with different distributions[J]. Journal of Shanghai Maritime University, 2009, 30 (3): 59-64, 68. (in Chinese) doi: 10.3969/j.issn.1672-9498.2009.03.014 -

下载:

下载: